The Reserve Bank of Australia (RBA) holds a prominent position among global Central Banks, wielding significant influence over the Australian Dollar's trajectory. Operating as a crucial player in shaping banking practices, the RBA maintains close collaboration with other International Central Banks.

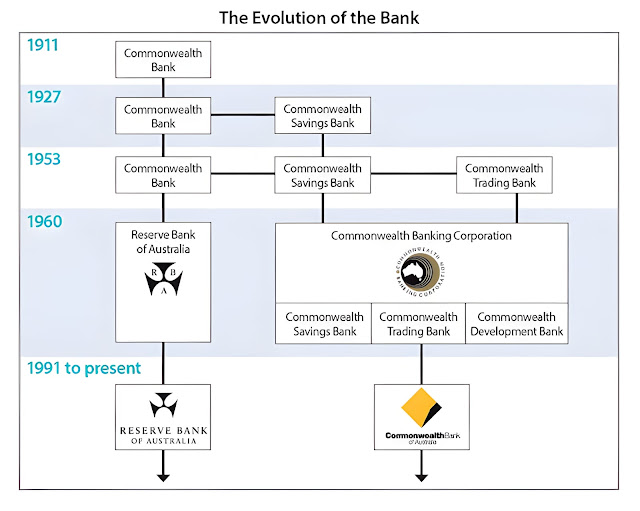

The RBA's roots can be traced back to the establishment of the Commonwealth Bank of Australia in 1911. Gradually assuming the responsibilities of a central bank, its authority was officially solidified after the Second World War through the Commonwealth Bank Act 1945 and the Banking Act 1945. As its central banking functions expanded, the need for a distinct entity became apparent, leading to the enactment of the Reserve Bank Act 1959. Consequently, the Reserve Bank of Australia (RBA) emerged and commenced its operations on 14 January 1960.

WHO OWNS THE RBA?

The Central Bank of Australia stands distinct as a wholly government-owned entity, diverging from numerous other global central banks that maintain private shareholdings like the Bank of Japan, the South African Reserve Bank, and the Swiss National Bank. Conversely, the US Federal Reserve presents a complex description, characterized as a hybrid public and private institution. Federal Reserve Banks are structured akin to private corporations, where member banks possess stock and reap dividends.

WHO IS ON THE BOARD OF RESERVE BANK OF AUSTRALIA (RBA) AND HOW ARE THEY APPOINTED?

The Reserve Bank of Australia (RBA) operates with a nine-member board, comprising the Governor, Deputy Governor, and the Secretary to the Treasury. Additionally, there are six non-executive members, handpicked by the Treasurer, serving for up to five years, with no term restrictions.

The Governor and Deputy Governor, however, have longer terms of up to seven years and are eligible for reappointment.

As stipulated in the Reserve Bank Act 1959, the RBA Governor is obliged to maintain communication with the Treasury Secretary regarding matters concerning both the Treasury and the Reserve Bank. To ensure transparency and accountability, the Governor and other senior members of the RBA appear twice a year before the House of Representatives Standing Committee on Economics, a practice that commenced in 1996.

ROLES AND RESPONSIBILITY OF THE RESERVE BANK OF AUSTRALIA?

The Reserve Bank of Australia (RBA) serves a crucial role as the nation's currency issuing authority and has the primary responsibility of ensuring monetary and banking policies support the welfare of the Australian people.

The RBA's key mandates encompass:

1. Currency Stability: The RBA endeavors to maintain the stability of the Australian currency, ensuring that it retains its value and is reliable in transactions.

2. Full Employment: The RBA aims to achieve and sustain full employment levels in Australia, typically targeting an unemployment rate of around 5-6%.

3. Economic Prosperity and Welfare: The RBA strives to promote economic prosperity and enhance the overall well-being of the people of Australia.

Over the years, the RBA has undergone significant changes while maintaining its fundamental objectives. In the early 1990s, it adopted an inflation targeting policy, which aims to keep the annual inflation rate at an average of 2-3%. This targeted inflation range was first established in 1993 and later formalized by then incoming Governor Ian Mcfarlane in 1996.

When inflation exceeds the 2-3% target, the RBA may opt to increase interest rates. Such an increase is intended to encourage capital flows into the country, potentially leading to an appreciation of the Australian Dollar due to the higher yield it offers.

The AUD/USD 15-minute chart depicts a distinctive surge following a 25bps interest rate hike, showcasing the instantaneous impact on the currency pair.

Please be advised: The diagram presented depicts the instant response to a 25 basis point increase on June 6, 2023. Subsequently, within a week following the declaration, the currency pair has surged by more than 150 pips.

THE IMPACT OF INTEREST RATES AND MONETARY POLICY ON THE AUSTRALIAN DOLLAR

The RBA uses monetary policy in the form of interest rate changes to maintain the stability of the currency and target inflation. A higher interest rate usually results in less money in circulation which in turn will increase demand and thus lead to a stronger currency, while a lower interest rate has the opposite effect. The reduction or ‘cutting’ of interest rates makes borrowing more attractive and results in more money in circulation. The increased supply leads to a weaker currency while stimulating investment into the economy as citizens look for a better return than the low interest rate environment offers.

It is important for traders to note that a change or no change in expectations may also have this effect. For example, if the RBA keeps interest rates steady but signals (tells the market) that they anticipate more interest rate cuts in the future, the value of the Australian Dollar will depreciate. This is the general rule and norm, however, there are times and situations when markets react differently, and this is what makes and keeps the markets interesting for many of us.

The table below shows the possible scenarios that result from a change in interest rate expectations. Traders can use this information to predict if the currency is likely to strengthen or weaken and how to trade it.

KEY POINTS ABOUT THE RBA

- The RBA was established and started operations on 14 January 1960.

- The RBA is fully owned by the Government with no private shareholders.

- The main objectives of the RBA are the stability of the Australian currency, the achievement of full employment in Australia (considered to be between 5-6% unemployment), and the economic prosperity and welfare of the Australian people.

- The main tools used by the RBA to pursue its objectives are changes to the interest rate as well as quantitative easing and tightening.