Selling currency short means betting on its fall in value. This practice was common in the commodity markets with agreed contracts, but now it is widespread in the forex market with any financial instrument. Traders use short selling to protect themselves from currency risk or to make money from their predictions.

In this article, you will learn how to sell forex short, using the EUR/USD pair as a case study to show the process. It also gives tips on how to manage risk at every stage of the trade.

HOW TO SELL CURRENCIES SHORT?

Many new traders find the idea of ‘short selling’ puzzling. How can we sell something we don’t have?

This is a concept that originated in stock markets before forex existed. Traders who wanted to profit from the price of a stock going down invented a clever way to do it.

Traders who wanted to bet on price falling may not have the stock they wanted to sell; but someone else probably did. Brokers saw this as a chance to connect their clients who owned the stock with other clients who wanted to sell it without having it. The traders who owned the stock long (buy position) may have different reasons for doing so. Maybe they bought it at a low price and don’t want to pay capital gains tax.

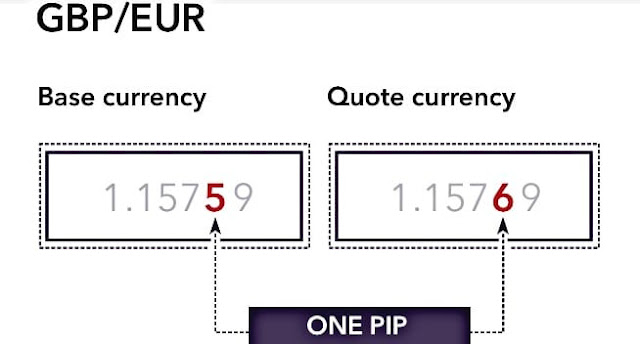

In the forex market, transactions work differently from stocks which means the method of short selling a currency pair is very different. First, a currency pair consists of a base currency and quote currency as shown in the image below. Each currency quote is given as a ‘two-sided transaction.’ When you sell a currency pair short, you are essentially selling the base currency and buying the quote currency hoping that the value of the of the currency pair will drop.

SELLING FOREX SHORT: AN EXAMPLE WITH EUR/USD

To take a short position in forex, you need to know about currency pairs, trading system functions and risk management.

First, each currency quote is given as a ‘two-sided transaction.’ This means that if you are selling the EUR/USD currency pair, you are not only selling Euros; but you are buying dollars. Because of this, you don’t need to ‘borrow’ anything to enable the short sale. In fact, quotes are shown in a very simple format that makes short-selling easier.

Want to sell the EUR/USD?

Simple. Just click on the side of the quote that says ‘Sell.’ After you have sold, to close the position, you would want to ‘Buy,’ the same amount (if you end up buying at a lower price than where it was sold, you would end up with a profit - excluding commission and fees). You could also choose to close part of your trade.

For example, let’s suppose we started a short position for $100,000 and sold EUR/USD when price was at 1.29.

If the price has moved lower, the trader could make a profit on the trade (excluding commissions and fees). But let’s suppose for a moment that our trader expected more declines and did not want to close the whole position. Instead, they wanted to close half of the position to cover the initial cost, while still keeping the chance to stay in the trade.

The trader that is short $100,000 EUR/USD can then manually enter in 0.5, then click on the ‘Close’ button to start the trade closing process of 50k - offsetting half of the 100k short position.

At that point, our trader would have made the price difference on half of the trade (50k) from their 1.29 entry price to the lower price they were able to close on. The rest of the trade would stay in the market until the trader decided to buy another 50k in EUR/USD to ‘balance,’ the rest of the position.

SELLING CURRENCIES SHORT: HOW TO REDUCE THE RISK

Short selling forex is very risky as there is no limit to how much you can lose on a trade. Losses are unlimited, as forex values can potentially rise to infinity. On a long (buy) trade, the value of a currency can never go below zero which provides a maximum loss level.

Managing risk on accounts was a quality we found with successful traders. Luckily, there are ways to lower this short selling risk:

- Use stop losses.

- Watch key levels of support and resistance for entry/exit points.

- Keep up with the latest economic news and events for possible downside risk.

- Use price alerts on trades is a good way to stay informed when you’re away from your platform. Price alerts are mobile/email notifications that update traders when certain price levels are reached on a specific market. These price alerts can be set to suit the traders key levels.

Short selling forex is suitable for down trending markets, however careful thought is required before trading as it brings extra risk even with a bearish outlook. It has been used by large institutions/traders as hedges, or by traders looking to trade falling markets. Risk management is essential for proper application, and the methods mentioned in this article should be given the utmost attention as negative movements in price can be harmful.

Follow for more: TradNx